- Projects

- …

- Projects

- Projects

- …

- Projects

Wealth Architecture: Designing a $266M Generational Legacy

A Case Study in Systemic Risk Mitigation and Multi-Generational Systems Design

This is a strategic blueprint for managing a $266 million lottery windfall. Most winners face a 70% bankruptcy rate within five years. This project demonstrates how to apply architectural thinking to transform sudden wealth from a liability into a sustainable, multi-generational asset.

My Role:

Strategic Systems Architect

The Problem: The "Lottery Curse"

Sudden wealth presents a catastrophic systems failure waiting to happen. The core challenges are not financial, but systemic:

- Psychological: The shock of wealth leads to impulsive decisions and identity loss.

- Social: Relationships are destroyed by unmanaged requests and expectations.

- Structural: Without proper architecture, assets are vulnerable to lawsuits, overspending, and poor investments.

- Legacy: Without a long-term plan, wealth rarely survives beyond the second generation.

The Solution: A Four-Layer Architectural Framework

Instead of a simple financial plan, I designed an integrated system with four interdependent layers. $900,000 in retention value (6.2× ROI)

Layer 1: The Governance Architecture (The "Rule of Law")

- Blind Trust: All assets placed in an anonymous trust managed by a professional institutional trustee (Northern Trust). This provides lawsuit protection, privacy, and removes emotional decision-making.

- Distribution Committee: A three-person board (Professional Trustee, Beneficiary, Independent Trust Protector) required for all major decisions, creating a system of checks and balances.

- Trust Protector: A dedicated role with the power to hire and fire the Trustee, acting as the beneficiary's ultimate advocate.

Layer 2: The Financial Architecture (The "Engine")

A hyper-conservative investment model designed for "infinite wealth" – the principle that only investment returns are spent, never the principal.

- Initial Capital: $266.2 Million (Post-Tax Lump Sum)

- Core Portfolio ($180M): 70% high-grade bonds, 30% blue-chip dividend stocks.

- Guaranteed Income ($50M): Treasury Bills and CDs generating $2.56M annually, risk-free.

- Annual Projected Returns: $15.5M - $17.2M

- Annual Spending Cap: $4.1M (including all lifestyle, family, and management costs)

- Result: The system generates a perpetual surplus, ensuring the principal grows indefinitely.

Layer 3: The Family & Social Architecture (The "Human Layer")

To prevent relational collapse, I designed a structured "Family Banking" program instead of open-handed giving.

- Tiered Access: Family and friends are categorized into tiers (Inner Circle, Family, Friends) with clear limits on loans and gifts.

- Structured Lending: A formal system for loans (0-5% interest) for education, homes, and medical emergencies, with required financial counseling.

- Automated Celebrations: A defined annual budget for gifts and experiences, replacing cash handouts.

- Professional Buffer: A hired Family Financial Advisor handles all requests, shielding personal relationships from financial tension.

Layer 4: The Legacy & Impact Architecture (The "Purpose")

- Charitable Foundation: A $4 million 501(c)(3) foundation with a mandate to give $280k annually to causes like local church infrastructure, youth entrepreneurship, and dementia research.

- Generational Planning: The trust is designed to exist in perpetuity, with education trusts and age-based distributions for future generations.

- Community Multiplier: The model is a template for generational wealth building within communities that have historically been excluded from it.

The Proof: The 47-Page Trust Constitution

The deliverable was not a presentation, but a fully-realized legal and operational blueprint.

- Document: A 47-page "Trust Constitution" codifying every rule, process, and safeguard.

- Safeguards: Multi-signature requirements, geographic transfer restrictions, and 72-hour waiting periods on large distributions.

- Dashboard: A concept for a real-time wealth dashboard tracking net worth, family banking activity, and charitable impact.

Strategic Impact & Business Value

- Risk Mitigation: The architecture systematically addresses the 5 primary causes of lottery winner bankruptcy.

- Value Created: Transforms a high-risk windfall into a predictable, growing financial engine.

- Scalability: The core principles are applicable to any sudden wealth scenario, from $2 million to $500 million.

Design Process Reflection

This project exemplifies pure strategic architecture. The value was not in the execution, but in the pre-emptive, systemic de-risking of a complex human and financial problem. It demonstrates a critical business truth: the cost of preventing a catastrophic failure is always less than the cost of the failure itself.

This case study is not about winning the lottery. It is about a methodology for designing fail-safe systems for high-stakes, multi-stakeholder environments.

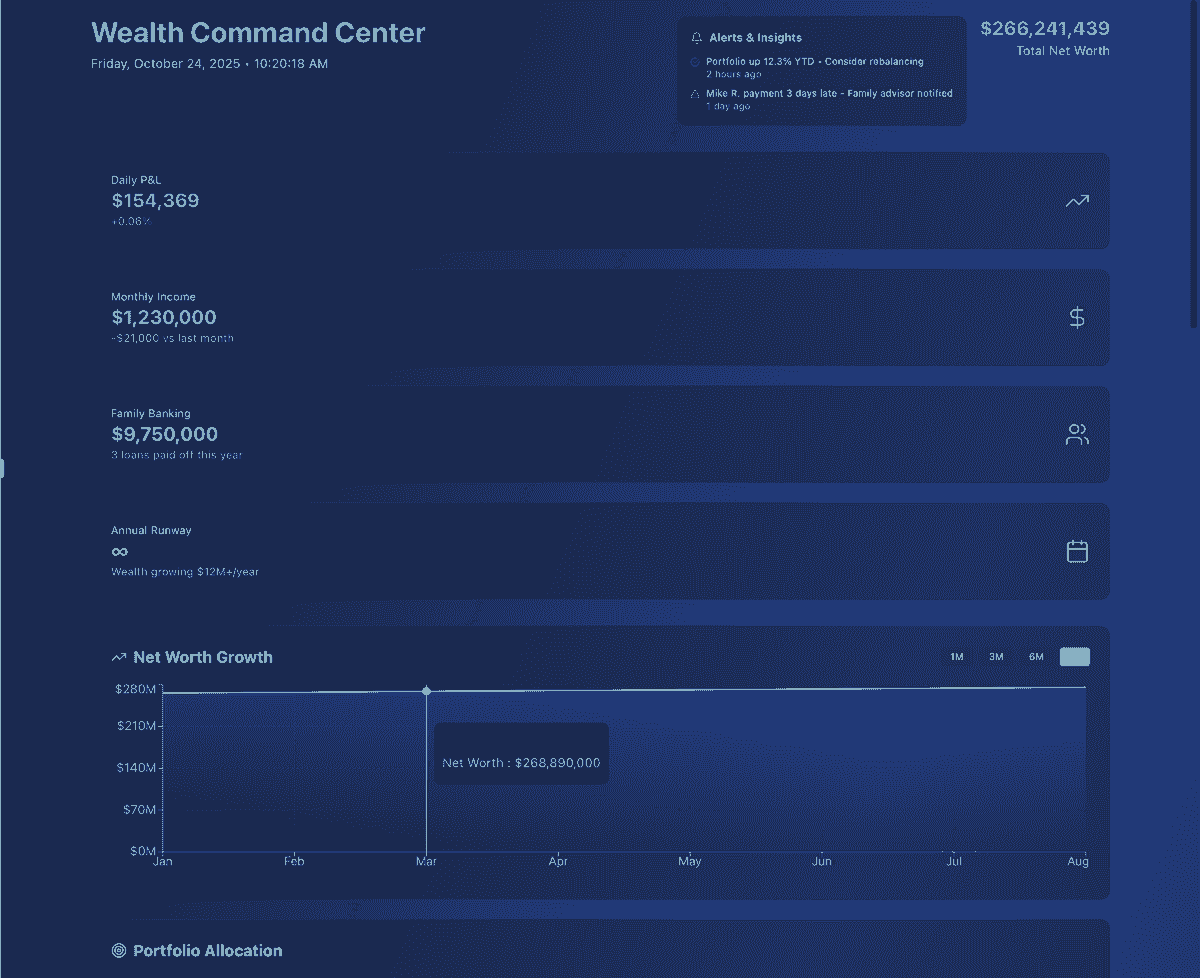

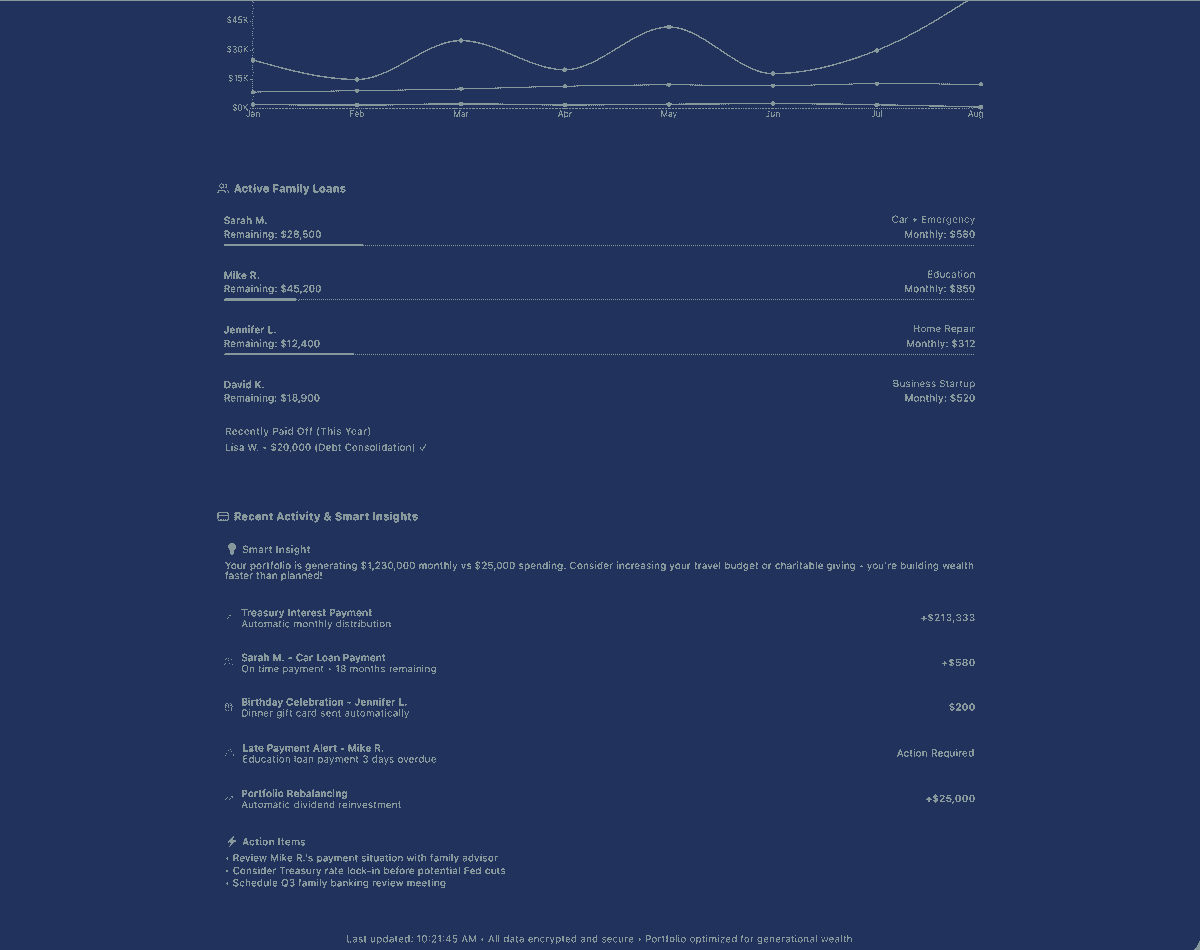

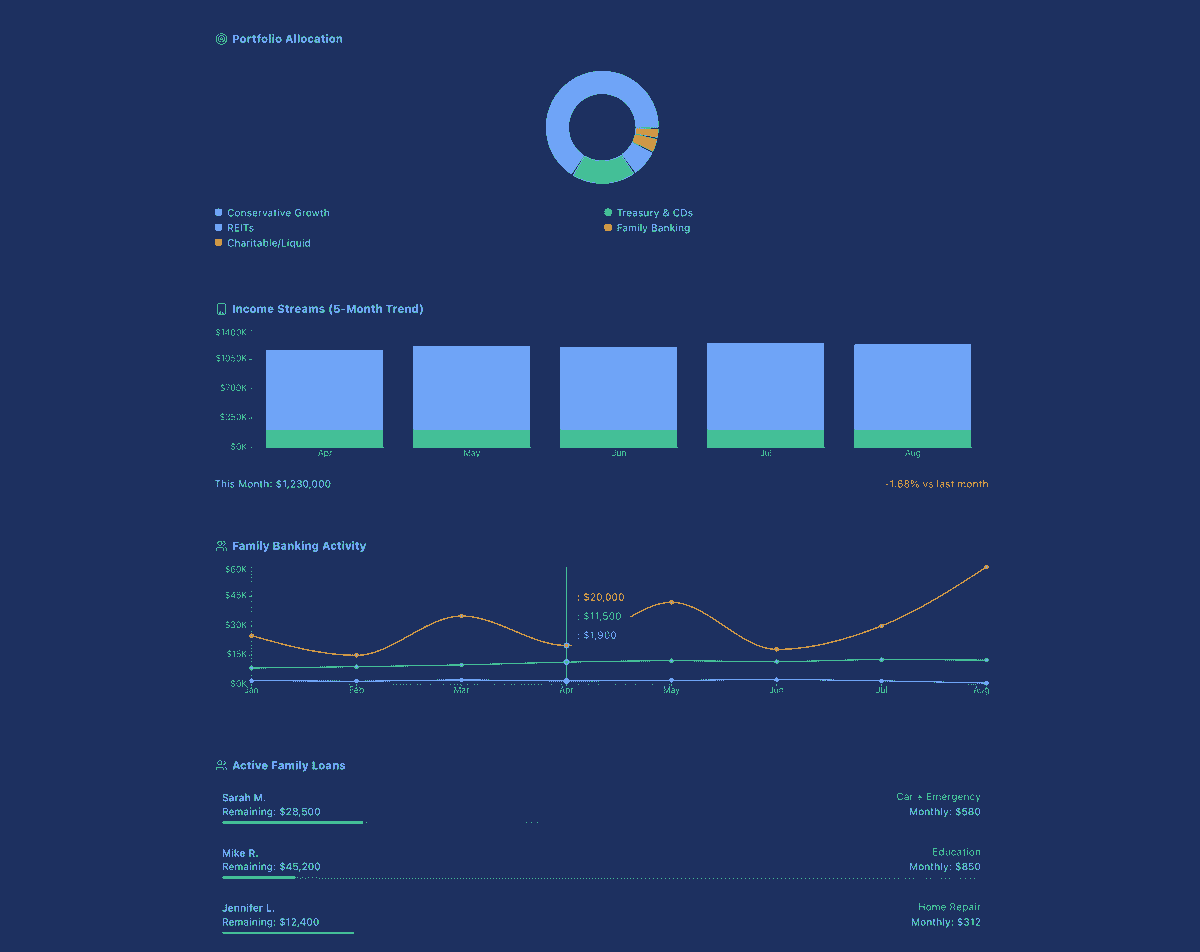

Interactive Wealth Command Center

This architecture includes a fully-designed dashboard system, prototyped in React/TypeScript with animated data visualizations. The interface transforms complex trust management into an intuitive, real-time overview.

Smart Insights

Real-time wealth monitoring with animated net worth tracking and portfolio allocation charts.

Portfolio Allocation | Income Streams | Family Loans

Loan management interface showing active requests, repayment status, and family tier structures

This prototype was built with modern web technologies including React, TypeScript, and Framer Motion for animations. The architecture demonstrates how complex financial data can be transformed into accessible, real-time insights.

Available for technical review upon request.

Wealth Architecture Case Study FAQs

Interested in the details behind this integration concept? Here's how QuickConfirm transforms casual conversation into reliable plans.

Is this just a theoretical exercise?

Why focus on such an unlikely scenario? What's the real-world value?

This seems overly complex. Isn't this over-engineering?

What was the most challenging part of this architecture?

Proudly built with Infinity Creative Group.